Global Markets in Freefall: Key Factors and Updates

Discover the key factors behind the recent global market meltdown, including the Bank of Japan's interest rate hike, economic signals from the US, and disappointing tech earnings.

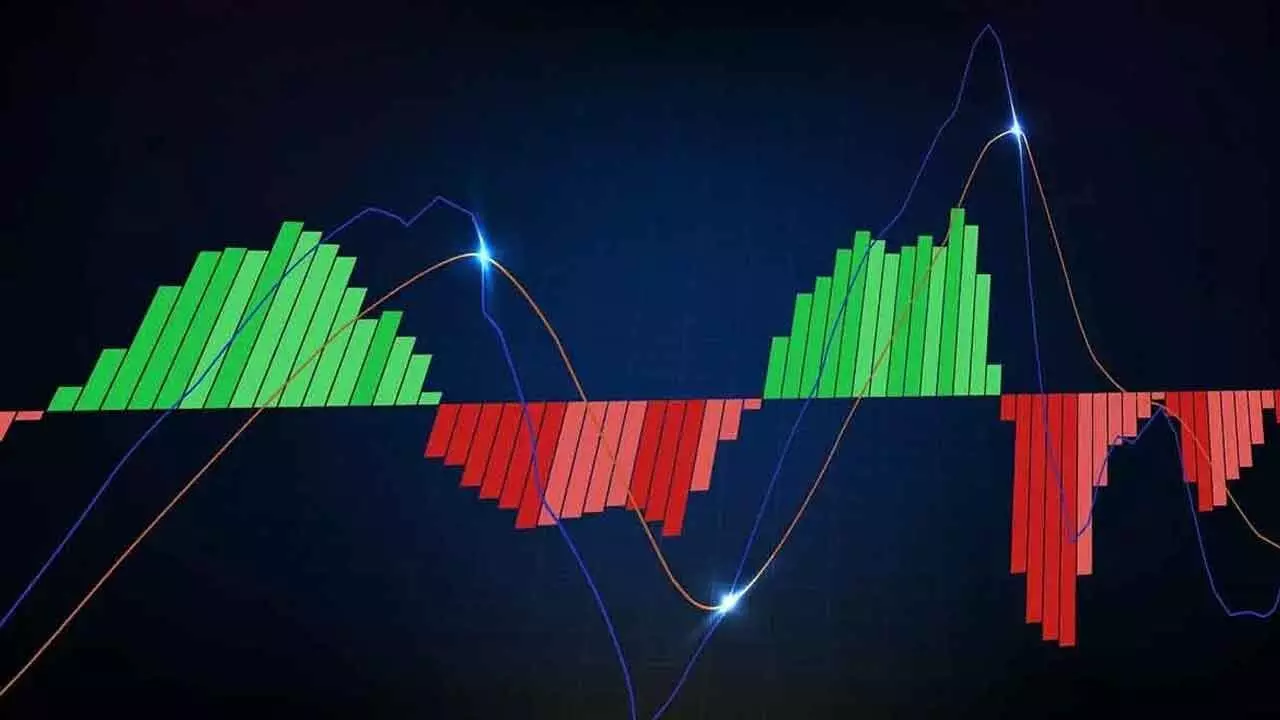

Chart depicting global stock market fluctuations with sharp declines and recoveries.

Global equity markets experienced a sharp sell-off on Friday, August 3, with major indices in the US, Europe, and Asia falling over 3%.

Japanese markets were the most severely impacted, plunging nearly 10% over two days, while US indices also dropped significantly, with the Nasdaq down nearly 6% and the Dow Jones and S&P 500 falling over 4%.

Japanese Interest Rate Hike:

Following the yen's drop to a record low of 161.9 against the dollar, the Bank of Japan raised its interest rate from 0-0.1% to 0.25%. This move had repercussions for the yen carry trade and contributed to a global decline in equity markets.

Signs of US Economic Slump:

US payrolls grew by just 1,14,000 in July, below the forecast of 1,75,000. Jobless claims increased to 2,49,000, and the ISM manufacturing PMI fell to 46.6, indicating contraction.

Tech Sector Disappointments:

Disappointing earnings from major tech firms, including Alphabet, Microsoft, and Amazon, led to significant declines in their stock prices. Intel reported a $1.6 billion loss and announced substantial job cuts, resulting in a nearly 40% drop in its share price.

Rising Recession Fears:

US unemployment rose to 4.3%, raising recession concerns. Sahm's rule, which signals a potential recession when unemployment increases significantly from its recent low, is now pointing to a possible economic downturn.